The Facts About Business Advisory Uncovered

The Facts About Business Advisory Uncovered

Blog Article

The Best Guide To Business Advisory

Table of ContentsExamine This Report on Business Advisory6 Simple Techniques For Business AdvisoryA Biased View of Business AdvisoryAll about Business AdvisoryAn Unbiased View of Business Advisory

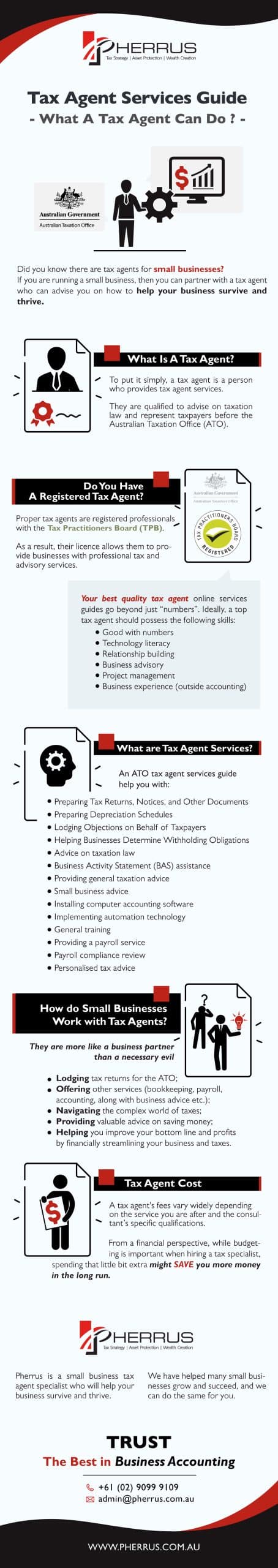

With 40 Companions and 300 team, we are dedicated to providing outstanding value to our clients. We are honored to be rated as the 22nd biggest company by income in the 2022 AFR Top 100 Audit Companies and the 10th biggest nationwide technique in Australia. At SW, we think in constructing genuine relationships and connectivity, both locally and globally.Running a small company includes its fair share of challengesmany of which stem from monetary monitoring concerns. Below's exactly how our solutions resolve usual issues encountered by tiny services: Browsing Australia's intricate tax obligation system can be frustrating for local business owners. We take care of all tax-related mattersfrom preparing returns to taking care of communications with the ATOensuring that you stay compliant with no frustrations.

If you own a tiny company, there are lots of free resources and services that can help you. is a terrific internet site to check out if you have inquiries regarding starting, running or growing a company in Australia (business advisory). It provides details about exactly how to establish up your funds, boost your cashflow, handle disputes and take care of being in financial obligation.

The Main Principles Of Business Advisory

Among one of the most usual inquiries we are asked as professional accountants for local business is: What entity should I utilize to run my service? It is an excellent concern; appropriately establishing your structure will certainly make a big distinction. North Advisory specialises in book-keeping for little services. Located on Sydney's Northern Beaches, we offer a diverse selection of small and moderate services locally and country wide.

While traditional media, social media sites, and, obviously, Google have a maze of details and guidance on the subject, much of it connects to companies and trust funds. Considering your scenario simply from a tax obligation benefit position might bring you unstuck, and there are several factors to consider prior to choosing one of the most proper technique for your conditions.

As an example, if you run a family members service and have your home, you'll wish to protect those personal properties from possible organization obligations. A business structurelike a Proprietary Limited (Pty Ltd)creates a border in between your personal and company liabilities. In riskier sectors, this separation can be a lifesaver. If your threat resistance is reduced, take into consideration layering your protection with a depend on that possesses the business (business advisory).

Little Known Facts About Business Advisory.

Currently, all of us go into service with an eye on the bigger prize. Owning a service has pros and disadvantages, and for those of you that have done it prior to or are doing it currently, you'll be well conscious of the struggles and the highs associated with owning and building something.

Are you building something that will grow and scale? Perhaps you're thinking of eventually selling business or passing it on to the future generation. In either case, your selected structure prepares for future success. Planning for development commonly suggests choosing a structure that permits reinvestment and the ability to generate exterior companions or capitalists.

Running a small company in Australia includes sticking to different conformity needs that play a vital role in its sustainable growth. Little organization compliance incorporates a range of laws and legislations that services need to follow to operate legitimately and fairly. This consists of obligations associated to taxation, work legislation, health and wellness requirements, and extra.

Unknown Facts About Business Advisory

By aligning with regulatory assumptions, companies not only stay clear of potential risks yet additionally build depend on with clients and stakeholders. At Accounts All Arranged, we acknowledge the intricacies associated with preserving compliance. Our team gives customized solutions to website link guarantee your company satisfies all necessary obligations seamlessly. With knowledge in bookkeepingwhich we believe is a smart relocation for small company ownerspayroll, and address business consultatory solutions across Australia, our objective is to keep your operations certified while you concentrate on growing your venture.

If you're interested in discovering more about how we can aid you, please feel complimentary to call us. Accounting franchise business play an important role in assisting tiny companies across Australia, specifically when it comes to remaining certified. These franchise business work as specialist networks, offering a variety of services created to meet the different requirements of small companies.

Selecting the ideal accounting franchise business is vital in ensuring your local business stays certified with Australian guidelines. Here are some important variables to consider: An accounting franchise business should have a proven track document in compliance support. This expertise ensures that your service adheres to the complex landscape of tax commitments and work regulations.

Continual Training: Ensure they offer recurring training for their team on the newest conformity requirements and accounting software application. The reputation of an accounting franchise speaks quantities concerning its reliability and efficacy. Client Reviews: Research customer comments and endorsements to determine satisfaction levels. Industry Honors: Awards or acknowledgments can suggest a franchise business's commitment to quality in compliance management.

How Business Advisory can Save You Time, Stress, and Money.

Our competence can aid in this area. Expecting the new economic year, we check these guys out provide support on starting the 2025 fiscal year right, making sure services are well-prepared for the difficulties ahead. Franchising provides an unique benefit for little companies having a hard time to navigate the intricacies of compliance. By aligning with an accounting franchise business, little ventures can use a durable support group developed to guarantee all regulatory responsibilities are met successfully.

Report this page